As the world continues to grapple with the effects of climate change, pressure is mounting on governments and businesses to take urgent action to reduce greenhouse gas emissions. Indeed, there’s rarely a day when the term ‘net zero’ doesn’t make national news headlines. It was added to the Oxford English dictionary in 2021, but there’s still considerable confusion around its definition. So, what exactly does ‘net zero’ mean, and why is it important for the pensions industry?

What is net zero?

So net zero is a simple way to describe a very complex calculation, where the total amount of greenhouse gas emissions from human activities released into the atmosphere is equal to those taken out. To balance this equation, the world needs to cut our emissions of greenhouse gases, including carbon dioxide and methane, to as close to zero as possible. And any emissions that can’t be avoided must be re-absorbed from the atmosphere naturally, for example, via oceans and forests, or using innovations such as carbon capture.

Achieving a net zero result requires every country, business and household to make changes in how they live and work. For individuals, this usually begins by reappraising the tangible things in our lives – all of which create warming emissions along the way: the food we eat, the waste we create, the energy we use. But there are just as many ‘intangibles’ to consider as people strive to make more sustainable choices. Many people are unaware that our pensions are one of the key areas where we as individuals can make a difference – by deciding where we invest our money.

What does net zero have to do with investments?

Some people choose to make their own decisions about how their pension is invested, but many rely on their pension company to do this for them. Everything we do has our customers’ best interests at its core. By taking the right actions to decarbonise, we can help protect our customers against climate-related risk and benefit from the growing sectors of the future.

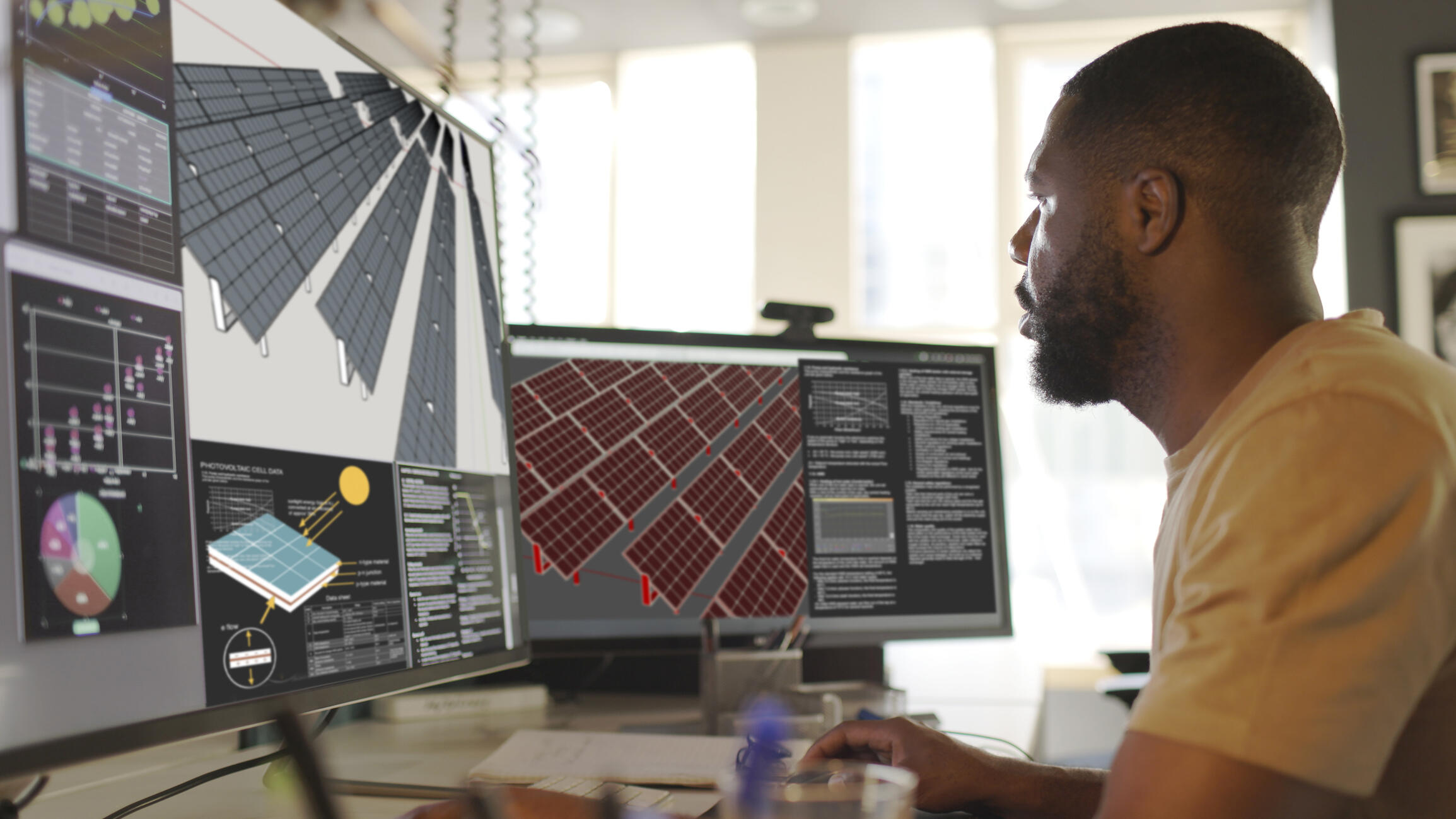

Because of the way pension funds are invested, they offer significant potential to spur action to tackle the climate crisis. Each pension fund is invested in a variety of different assets, such as companies, projects and government bonds across various sectors and geographies, and directly or indirectly, all of these investments generate emissions.

As the UK’s largest long-term savings and retirement business we have the scale to make a real difference. We have some work to do but we’re committed to becoming a net zero business by 2050 and our Net Zero Transition Plan maps out this journey, focusing on the three areas where we believe we can make the most impact: by decarbonising our investments, engaging with customers and stakeholders to drive change, and decarbonising our own operations and supply chain